Stay up to date with free updates

Simply log in Inflation in the UK myFT Digest – delivered straight to your inbox.

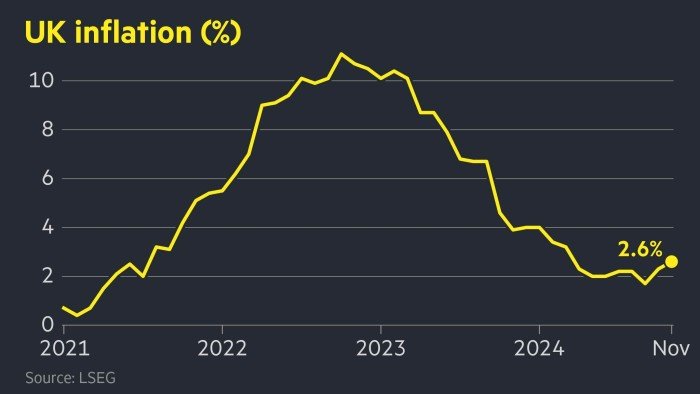

British inflation accelerated to 2.6 percent in November, in line with analysts’ forecasts, confirming expectations that the Bank of England will keep interest rates steady at its meeting on Thursday.

The year-on-year increase in the consumer price index was higher than the 2.3 percent recorded in October, as the cost of fuel and clothing helps drive up the annual rate.

The Office for National Statistics data comes from a meeting of the BoE’s monetary policy committee this week to set interest rates amid signs of a stagnant economy.

GDP has contracted for two consecutive months, while business surveys point to weaker confidence and lower hiring intentions. But a pickup in the UK Wage growth has helped dispel hopes of a rate cut this week.

The service sector inflation rate, closely watched by the central bank as a measure of underlying domestic price pressures, was 5 percent in November, in line with October but below analysts’ expectations of 5.1 percent.

BoE policymakers have highlighted persistent inflation in the services sector as a reason for caution before cutting interest rates again, after cutting the key interest rate in two quarter-percentage steps to 4.75 percent this year.

Gov. Andrew Bailey said this BoE the policy will continue to be gradually relaxed. Clare Lombardelli, the deputy governor, told the Financial Times in November that she was concerned that price inflation in the services sector remained “well above” the BoE’s 2 percent target.

The price value for services in November was slightly above the BoE’s own forecast of 4.9 percent.

“This rise in inflation dashes any lingering hopes of a rate cut on Thursday, while concerns about rising inflation risks, including the recent pick-up in wage growth, mean that easing in February is not yet a done deal,” said Suren Thiru, economics director at accounting body ICAEW .

“I know families are still struggling with the cost of living and today’s figures are a reminder that the economy has not worked for working people for too long,” said Chancellor Rachel Reeves.

After the data was released, the pound fell 0.1 percent to $1.269.