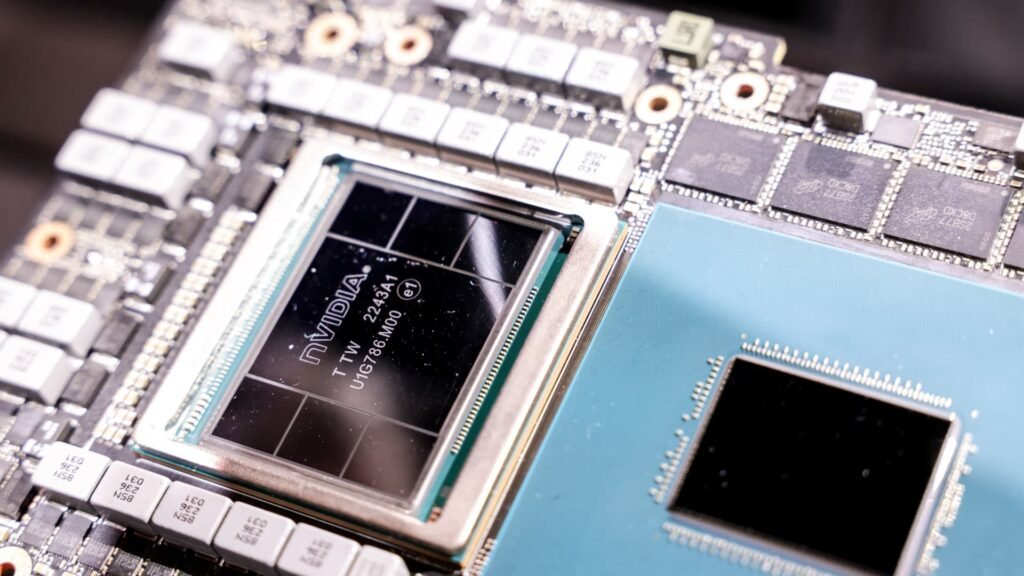

An Nvidia chip during the Taipei Computex Expo in Taipei, Taiwan, on May 29, 2023.

Bloomberg | Bloomberg | Getty Images

Stocks in Asia-Pacific had a strong run in 2024, with most major markets ending the year higher as the region’s central banks eased monetary policy while an AI boom boosted tech stocks.

Taiwan Taix led gains in the region, rising 28.85% on December 23, while Hong Kong Hang Seng Index took second place with 16.52%.

Asia successful Inflation was brought down faster than in the rest of the worldsaid Mike Shiao, chief investment officer for Asia ex-Japan at investment management firm Invesco, paving the way for monetary easing.

“Now that the Federal Reserve has begun its easing cycle, Asian countries will have more room to cut interest rates in 2025,” he said in a note. Looser monetary policy tends to benefit the stock market.

The market’s focus on technology and technology-related stocks helped boost the Taiex. Heavyweights Taiwan Semiconductor Manufacturing Company rose 82.12% in 2024, and major Apple supplier Foxconn – traded as Hon Hai precision industry 77.51% advanced.

While the Demand for AI data centers and servers may weaken After a sharp increase this year, demand for AI-enabled mobile phones, PCs and other consumer electronics could rise in 2025, said a forecast note from DBS Bank.

DBS noted that the global semiconductor sector typically goes through an expansion cycle of around 30 months. The current cycle, which began in September 2023, has the potential to extend until the end of 2025.

While tech stocks helped Taiwan recover, they couldn’t save South Korea, which was the only major Asian market to end the year in the red. The country’s corporate value-up program appears to have failed to boost inventories amid fears of tariffs Political unrest increases uncertainty.

The measure of the country Kospi lost 8.03% on December 23, making it the worst-performing Asian market.

Major economies, particularly the United States and China, will have a major impact on South Korea’s export-oriented economy, said Paul Kim, head of equities at Eastspring Investments, in the company’s 2025 outlook.

“Large exporters such as IT hardware and automobile manufacturers may face challenges,” he added.

The impeachment of President Yoon Suk Yeol will undoubtedly weigh on investors’ minds. Lorraine Tan, head of Asia equity research at Morningstar, told CNBC earlier this year: “The longer the leadership transition takes, the more likely it is that investors will be sidelined.”

Kim also said the government will play a key role in the country’s markets, stressing that possible corporate regulatory reforms, fiscal stimulus measures and the possibility of further interest rate cuts by the Bank of Korea could improve the business environment and boost domestic demand.

Outlook 2025

According to George Maris, chief investment officer and global head of equities at Principal Asset Management, Donald Trump’s presidency and the state of China’s economy in 2025 will be two key areas of investor attention.

According to Nomura, the policies of the new Trump administration will likely influence the growth and inflation outlook in 2025 in Asia. “We expect an increase in tariffs early next year, which will lead to a rise in inflation and slower investment growth.”

Nomura said higher tariffs and trade barriers would lead to weaker exports from Asia. Increased insecurity and retaliation could delay business investment in the region.

Industrial and trade-dependent economies like those in Asia are likely to be hit harder “as tariffs lead to lower trade flows and put downward pressure on growth,” Freida Tay, portfolio manager of institutional bonds at global investment manager MFS Investment Management told CNBC.

Nomura predicts Asia will also have to contend with tighter global financial conditions in 2025 due to higher interest rates and a stronger dollar.

The US Federal Reserve will decide at its last meeting in 2024 signaled that there will be fewer interest rate cuts in 2025, while inflation forecasts were raised.

Nomura sees “different monetary policy outlooks” across the region and says countries like China, Australia, South Korea and Indonesia, which are more exposed to exchange rate risks, will see monetary policy easing in 2025.

Loose monetary policy typically weakens a country’s currency, making exports cheaper and potentially supporting growth in the face of tariffs.

On the other hand, countries with “strong growth, higher inflation and still accommodative monetary conditions” will raise interest rates, such as Japan and Malaysia.

In general, according to experts, the year 2025 is associated with great uncertainty.

Nomura analysts write that the region is “headed for turbulence,” noting that while strong AI demand and forward export exports should provide some growth support in the first quarter, the region is “heading for rougher seas” starting in the second quarter “seems” due to impacts from Trump’s presidency, China’s overcapacity and a slowing semiconductor cycle.

However, the company sees above-average growth performance in Asian economies with stronger domestic demand buffers such as Malaysia and the Philippines, while India, Thailand and South Korea are likely to face headwinds.

China: Challenges and Opportunities

The state of China’s economy will also be a key focus for Asian investors, with traders looking for a “meaningful commitment to sustainable growth” in Asia’s second-largest economy, Maris said.

In 2024, China’s stock markets broke a three-year losing streak, with the CSI 300 gaining 14.64% as Beijing focused on supporting its economy.

Nomura analysts expect more stimulus from China to support its economy, while stressing that Beijing needs to stabilize its battered real estate market, repair its tax system, boost welfare and ease geopolitical tensions to “achieve a real, sustainable recovery.” .”

“This is a tall order at a time when China’s exports – the biggest driver of growth in 2024 – could face strong headwinds upon Trump’s return. Although Beijing will stick to the GDP growth target of “around 5%,” we expect growth to slow from 4.8% in 2024 to 4.0% in 2025,” Nomura said.

Maris sees an opportunity in the world’s second largest economy. He expressed himself “constructively” towards companies that have contact with Chinese consumers.

He said these companies often trade at attractive valuations “given the prevailing negative sentiment,” but should government stimulus come through, these companies would likely benefit from improved demand.